How to use business intelligence for competitive advantage? It’s the million-dollar question every forward-thinking business is grappling with. In today’s hyper-competitive landscape, leveraging data isn’t just a good idea—it’s a survival necessity. From identifying hidden market trends to crafting killer strategies, business intelligence (BI) offers a powerful toolkit for outmaneuvering rivals and securing lasting success. This deep dive will unpack how to harness the power of BI to gain a significant edge in your market.

We’ll explore everything from identifying the right data sources and mastering analytical techniques to effectively communicating your findings and measuring the impact of your BI initiatives. Get ready to transform your business from data-driven to data-dominated!

Defining Competitive Advantage Through Business Intelligence

In today’s hyper-competitive business landscape, gaining and maintaining a sustainable competitive advantage is paramount. Business intelligence (BI), the process of gathering, analyzing, and interpreting data to drive better business decisions, plays a crucial role in achieving this. By leveraging BI, companies can unlock hidden insights, anticipate market trends, and ultimately outperform their rivals. This section delves into how BI contributes to a lasting competitive edge.

Business intelligence provides a sustainable competitive edge by enabling data-driven decision-making. Unlike traditional methods relying on intuition or gut feeling, BI utilizes hard data to inform strategic choices. This leads to more accurate predictions, improved resource allocation, and a more agile response to market changes. The ability to anticipate shifts in customer behavior, identify emerging opportunities, and mitigate potential threats is a significant advantage that only data-driven insights can provide.

Examples of Companies Leveraging BI for Market Gains

Several companies have demonstrated the transformative power of BI in achieving significant market gains. For instance, Amazon’s sophisticated recommendation engine, powered by vast amounts of customer data analysis, fuels its sales and enhances customer loyalty. Netflix utilizes BI to analyze viewing habits, predict future trends, and inform its content creation strategy, leading to its global dominance in the streaming industry.

Similarly, Walmart’s use of BI for supply chain optimization and inventory management ensures efficient operations and minimizes waste, providing a cost advantage over competitors. These examples highlight the potential for BI to deliver tangible, market-leading results.

Key Performance Indicators (KPIs) Relevant to Competitive Advantage

Identifying and tracking the right KPIs is critical to measuring the effectiveness of BI initiatives and achieving a competitive advantage. Some of the most relevant KPIs include:

Several key performance indicators (KPIs) are vital for measuring the impact of BI and its contribution to competitive advantage. These metrics provide a quantifiable assessment of success and guide strategic adjustments. For example, customer churn rate reveals the effectiveness of customer retention strategies, while market share reflects the company’s competitive positioning. Return on investment (ROI) of BI initiatives demonstrates its financial impact, and lead conversion rate highlights the efficiency of sales and marketing efforts.

Finally, customer lifetime value (CLTV) provides a long-term perspective on customer profitability.

Comparison of Traditional and BI-Driven Business Strategies

The following table compares traditional business strategies with BI-enhanced approaches, highlighting the competitive advantages gained through data-driven decision-making.

| Strategy | Traditional Approach | BI-Enhanced Approach | Competitive Advantage Gained |

|---|---|---|---|

| Marketing | Generic marketing campaigns based on assumptions and intuition. | Targeted campaigns based on customer segmentation and behavior analysis, personalized messaging. | Increased conversion rates, improved customer engagement, higher ROI on marketing spend. |

| Sales | Reactive sales processes, focusing on existing customers. | Proactive sales strategies identifying high-potential leads, predictive sales forecasting. | Increased sales volume, improved sales forecasting accuracy, higher win rates. |

| Product Development | Product development based on market research and expert opinions. | Data-driven product development based on customer feedback, market trends, and competitive analysis. | Faster time-to-market, improved product-market fit, higher customer satisfaction. |

| Operations | Manual processes, inefficient resource allocation. | Automated processes, optimized resource allocation, real-time performance monitoring. | Reduced operational costs, improved efficiency, enhanced productivity. |

Data Sources and Acquisition for Competitive Insights

Unlocking a competitive edge hinges on leveraging the power of data. Business intelligence (BI) transforms raw information into actionable insights, but only if you’re sourcing the right data effectively. This section delves into identifying key data sources, integrating them seamlessly, and navigating the ethical considerations involved in competitive intelligence gathering.

Effective data acquisition is a multi-faceted process. It requires a strategic approach encompassing both internal and external data sources, robust integration methods, and a keen awareness of ethical boundaries. Ignoring any of these aspects can severely limit the value of your BI initiatives and even expose your company to legal or reputational risks.

Internal Data Sources for Competitive Analysis

Internal data offers a wealth of information about your own operations, providing a crucial baseline for comparison against competitors. This includes sales figures, marketing campaign performance, customer feedback, operational efficiency metrics, and internal communications. Analyzing this data reveals areas of strength and weakness, informing strategic decisions and highlighting opportunities for improvement. For example, analyzing sales data segmented by product line can pinpoint high-performing products and identify areas needing further development.

Similarly, analyzing customer feedback can highlight unmet needs, allowing for product innovation or service improvement to gain a competitive edge.

External Data Sources for Competitive Analysis

Beyond internal data, external sources provide a broader perspective on the competitive landscape. Market research reports offer valuable insights into industry trends, competitor strategies, and customer preferences. Publicly available financial statements of competitors reveal their financial health and investment priorities. Social media monitoring reveals customer sentiment and brand perception, allowing for proactive reputation management. Finally, news articles, industry publications, and patent filings can provide crucial information about competitor innovation and strategic moves.

Analyzing competitor pricing strategies through publicly available information can inform your own pricing decisions, optimizing profitability while maintaining competitiveness.

Data Integration and Cleansing Best Practices

Integrating data from diverse sources is crucial for comprehensive competitive analysis. This involves consolidating data from various internal systems (CRM, ERP, marketing automation) and external sources (market research reports, social media data). Data cleansing is equally important; this process involves identifying and correcting inaccuracies, inconsistencies, and missing data points. Employing data quality tools and establishing standardized data formats are vital for accurate and reliable BI.

For instance, ensuring consistent product naming conventions across all data sources prevents misinterpretations and improves the accuracy of sales analyses. Data validation rules can be implemented to automatically flag potential errors during the integration process.

Ethical Considerations in Gathering and Using Competitive Data

Ethical data acquisition is paramount. Competitive intelligence should be obtained through legal and ethical means, respecting privacy laws and intellectual property rights. Scraping data without consent is illegal and unethical. Information obtained through illicit means should never be used, even if seemingly beneficial. Instead, focus on publicly available data and information that is ethically and legally accessible.

Transparency within your organization regarding data acquisition methods is crucial for maintaining ethical standards and building trust. For example, clearly defining what constitutes acceptable data collection methods in your company’s code of conduct will establish clear guidelines for employees.

Data Acquisition Plan for a New Market Entry

Imagine a hypothetical company, “InnovateTech,” entering the smart home automation market. Their data acquisition plan would involve:

- Internal Data: Analyze existing customer data from related product lines to identify potential overlaps in customer demographics and preferences.

- External Data: Conduct market research to identify key competitors, their market share, pricing strategies, and product features. Monitor social media conversations to understand customer sentiment towards existing smart home products.

- Data Integration: Develop a centralized data warehouse to consolidate internal and external data. Implement data cleansing procedures to ensure data accuracy.

- Ethical Considerations: Establish clear guidelines for data collection, ensuring compliance with privacy laws and ethical standards. Utilize only publicly available information and conduct all research legally.

This structured approach enables InnovateTech to gain a competitive advantage by making informed decisions about product development, pricing, and marketing strategies.

Analyzing Data for Competitive Intelligence

Unlocking a competitive edge hinges on effectively analyzing the data you’ve gathered. This involves more than just looking at numbers; it’s about uncovering hidden patterns, predicting future trends, and ultimately, making informed business decisions that leave your competitors in the dust. This section delves into the techniques and tools that empower you to do just that.

Analytical Techniques for Competitive Insights

Extracting actionable insights requires a blend of quantitative and qualitative analysis. Quantitative analysis uses statistical methods to identify trends and correlations within numerical data. This could involve regression analysis to understand the relationship between marketing spend and sales, or time series analysis to forecast future demand. Qualitative analysis, on the other hand, involves interpreting non-numerical data such as customer reviews, competitor marketing materials, and news articles to understand the sentiment and context surrounding your market.

Combining both approaches provides a holistic understanding of the competitive landscape. For example, analyzing sales data alongside customer feedback can reveal which product features are driving sales and which are causing customer dissatisfaction, leading to targeted product improvements.

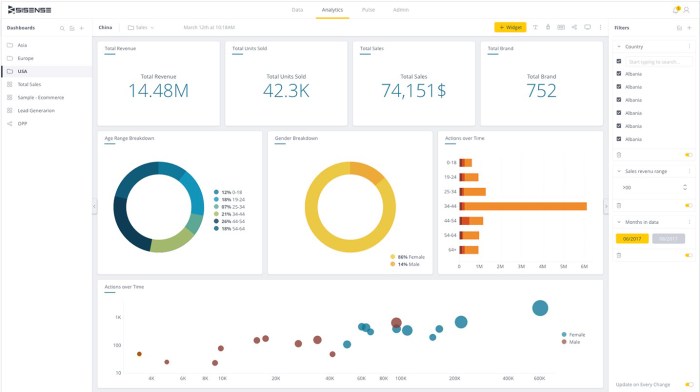

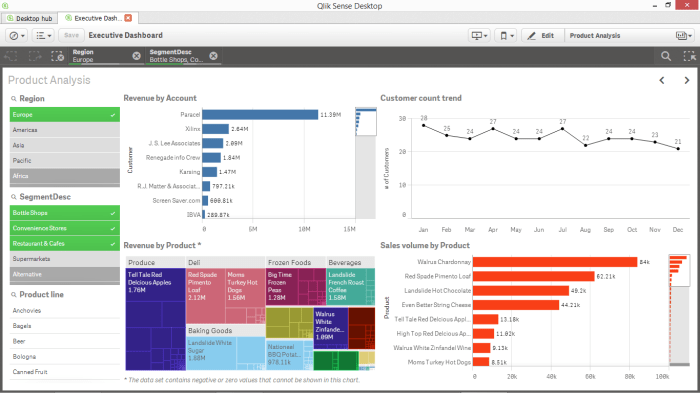

Data Visualization for Identifying Market Trends

Data visualization is crucial for transforming raw data into easily digestible insights. Charts and graphs can reveal patterns and trends that might be missed when looking at spreadsheets alone. For instance, a line graph showing sales figures over time might reveal a seasonal trend, while a bar chart comparing market share across different competitors can highlight areas of strength and weakness.

A heatmap visualizing customer demographics and purchasing behavior can identify key customer segments and their preferences. Consider a hypothetical scenario: a company visualizing customer location data on a map might notice a concentration of sales in a specific region, suggesting an opportunity for targeted marketing or even a new physical store location. This visual representation provides immediate clarity and actionable insights that a table of numbers alone cannot.

Comparative Analysis of BI Tools

Several Business Intelligence (BI) tools cater to different needs and budgets. Tableau, known for its user-friendly interface and powerful visualization capabilities, is ideal for quickly creating dashboards and exploring data interactively. Power BI, Microsoft’s offering, seamlessly integrates with other Microsoft products and provides robust reporting and data modeling features. Qlik Sense excels at associative data analysis, allowing users to explore connections between different data points effortlessly.

The choice of tool depends on factors like the size and complexity of your data, your budget, and your team’s technical expertise. A smaller company with limited resources might find Tableau’s ease of use beneficial, while a larger enterprise with extensive data might opt for the scalability and advanced features of Power BI or Qlik Sense.

Step-by-Step Competitive Analysis using BI

Conducting a comprehensive competitive analysis using BI involves a structured approach:

- Define Objectives: Clearly Artikel the goals of your analysis. What specific questions are you trying to answer? Are you looking to identify new market opportunities, understand competitor strategies, or optimize pricing?

- Data Collection: Gather relevant data from various sources, including internal sales data, market research reports, competitor websites, and social media. Ensure data quality and consistency.

- Data Cleaning and Preparation: Cleanse and transform the data to ensure accuracy and consistency. This might involve handling missing values, standardizing data formats, and removing duplicates.

- Data Analysis: Employ appropriate analytical techniques, such as regression analysis, time series forecasting, and segmentation, to identify trends and patterns.

- Data Visualization: Create compelling visualizations, such as charts, graphs, and dashboards, to communicate insights effectively.

- Actionable Insights: Translate the findings into actionable strategies. Develop recommendations based on the analysis to improve your competitive position.

Actionable Insights and Strategic Decision-Making

Harnessing the power of business intelligence (BI) isn’t just about collecting data; it’s about transforming raw information into actionable strategies that propel your business forward. BI provides a clear view of your competitive landscape, revealing opportunities and threats you might otherwise miss. This allows for proactive, data-driven decision-making, significantly increasing your chances of success.BI-derived insights translate directly into tangible business strategies by providing a factual basis for informed choices.

Instead of relying on gut feelings or guesswork, businesses can leverage data to optimize various aspects of their operations, from pricing and product development to marketing and customer service. This data-driven approach minimizes risk and maximizes return on investment.

Pricing Strategies Informed by BI, How to use business intelligence for competitive advantage

Effective pricing hinges on understanding market dynamics, customer behavior, and competitor actions. BI tools can analyze vast datasets to identify optimal pricing points that maximize revenue while maintaining competitiveness. For example, a company could use BI to analyze the price elasticity of demand for its product, revealing how sensitive customers are to price changes. This analysis would then inform a dynamic pricing strategy, adjusting prices based on real-time market conditions and customer segmentation.

Imagine a subscription-based service using BI to identify customer segments willing to pay a premium for added features, enabling the creation of tiered pricing plans that optimize revenue.

Product Development Guided by BI

BI provides crucial insights into customer needs and preferences, enabling companies to develop products that resonate with their target market. By analyzing customer feedback, sales data, and market trends, businesses can identify gaps in the market and opportunities for innovation. For instance, a consumer goods company might use BI to analyze social media sentiment surrounding its products, identifying areas for improvement or new product ideas.

Obtain access to What are the key features to look for when comparing different CRM systems to private resources that are additional.

Analyzing sales data alongside customer demographics can pinpoint underserved segments, leading to the development of niche products tailored to specific customer needs. This approach reduces the risk of developing products that fail to meet market demand.

Marketing Campaigns Optimized with BI

BI plays a pivotal role in creating targeted and effective marketing campaigns. By analyzing customer demographics, purchasing history, and website behavior, businesses can segment their audience and tailor their messaging accordingly. This allows for personalized marketing experiences, leading to increased engagement and conversion rates. A retail company might utilize BI to analyze customer purchase patterns and preferences, enabling them to create highly targeted email campaigns promoting relevant products or services.

Furthermore, analyzing website analytics can reveal which marketing channels are most effective, allowing for optimized resource allocation and improved ROI on marketing investments.

Communicating BI Findings to Stakeholders

Effectively communicating BI findings is crucial for ensuring that insights are translated into action. This involves creating clear, concise, and visually appealing presentations that highlight key findings and recommendations. The presentation should be tailored to the audience, using language and visuals that are easily understood. For example, a presentation to senior management might focus on high-level strategic implications, while a presentation to the marketing team might delve into more granular details.

Hypothetical Competitive Analysis Presentation Summary

A hypothetical competitive analysis of the coffee market might reveal that a specific competitor is gaining market share by focusing on sustainable sourcing and ethical labor practices. The presentation would summarize this finding, highlighting the competitor’s strategy and its impact on market dynamics. It would also include recommendations for responding to this competitive threat, such as investing in sustainable sourcing initiatives or highlighting the company’s own ethical practices.

The presentation would utilize charts and graphs to visualize key data points, making the information easily digestible and impactful for the audience. This visual representation of the data strengthens the presentation’s impact and reinforces the strategic recommendations.

Implementing and Managing a BI System for Competitive Advantage

Successfully implementing a Business Intelligence (BI) system isn’t just about acquiring the latest software; it’s about strategically integrating data analysis into the core of your business operations to gain a lasting competitive edge. A well-structured implementation plan, coupled with the right technological infrastructure and skilled personnel, is crucial for maximizing the return on investment and ensuring the system’s longevity.Key Elements of a Successful BI Implementation StrategyA successful BI implementation hinges on a well-defined strategy.

This involves clearly articulating business objectives, identifying key performance indicators (KPIs), and selecting the appropriate BI tools and technologies. It also requires a phased approach, starting with a pilot project to test and refine the system before full-scale deployment. This iterative process allows for continuous improvement and adaptation based on feedback and evolving business needs. For example, a retail company might start by analyzing sales data from a single store before expanding to a regional or national level.

This minimizes risk and allows for course correction early on.

Technology and Human Capital in Maximizing BI Effectiveness

Technology provides the backbone of any effective BI system. This includes data warehousing solutions for efficient data storage and retrieval, data visualization tools for creating insightful dashboards and reports, and advanced analytics platforms for predictive modeling and forecasting. However, technology alone is insufficient. Human capital, encompassing data analysts, business intelligence specialists, and data scientists, is crucial for interpreting data, identifying trends, and translating insights into actionable strategies.

These professionals need the skills to not only use the BI tools but also to understand the business context and translate data into meaningful business decisions. Consider a scenario where a company invests in sophisticated AI-powered analytics but lacks personnel capable of interpreting the complex output; the investment becomes essentially wasted.

Challenges Associated with Implementing and Maintaining a BI System

Implementing and maintaining a BI system presents several challenges. Data integration from disparate sources can be complex and time-consuming, requiring significant effort to ensure data consistency and accuracy. Ensuring data security and privacy is paramount, necessitating robust security measures to protect sensitive information. Furthermore, maintaining the system requires ongoing investment in infrastructure, software updates, and personnel training. The lack of skilled personnel, coupled with high initial investment costs, often poses a major hurdle for smaller businesses.

For instance, the cost of specialized software licenses and the need for ongoing technical support can be substantial, impacting smaller companies’ ability to adopt advanced BI systems.

Comprehensive Training Program for Employees

A comprehensive training program is vital to ensure employees can effectively utilize BI tools and interpret the insights generated. The program should be tailored to different user roles and skill levels, providing both technical training on software usage and business-oriented training on data interpretation and strategic decision-making. This can involve a combination of online courses, workshops, and on-the-job mentoring.

For example, a training program could begin with introductory sessions focusing on basic data visualization and reporting, followed by advanced workshops on predictive modeling and forecasting for data analysts. Regular refresher courses and ongoing support should also be provided to maintain proficiency and address evolving needs.

Measuring the Impact of Business Intelligence on Competitive Advantage: How To Use Business Intelligence For Competitive Advantage

Successfully implementing Business Intelligence (BI) isn’t just about collecting data; it’s about demonstrably improving your competitive standing. Measuring the impact of your BI initiatives is crucial to justifying continued investment and refining your strategies. This involves identifying key performance indicators (KPIs), tracking them effectively, and visualizing the results to showcase the return on investment (ROI).

Key Metrics for Assessing BI Effectiveness

Effective measurement requires focusing on metrics directly linked to business goals. Simply tracking data volume isn’t enough; you need to understand how that data translates into tangible benefits. The specific metrics will vary depending on your industry and business objectives, but some universally applicable KPIs include improved decision-making speed, reduced operational costs, and enhanced customer satisfaction. Focusing on these key areas allows for a comprehensive evaluation of the BI system’s contribution to the overall business strategy.

Best Practices for Monitoring and Evaluating BI ROI

Monitoring and evaluating the ROI of BI requires a structured approach. This includes establishing clear baseline metrics before implementing the BI system. This allows for a direct comparison and quantifiable demonstration of improvements post-implementation. Regular reporting and analysis are also vital, providing insights into areas for optimization and highlighting the ongoing value of the BI system. Regular reviews, perhaps quarterly or annually, should assess whether the BI system is meeting its objectives and if adjustments are needed.

Tracking BI’s Impact on Key Business Outcomes

The ultimate goal of BI is to improve key business outcomes. This could involve increased market share, improved profitability, enhanced customer retention, or faster product development cycles. Tracking these outcomes requires connecting BI-driven insights to specific actions and measuring the resulting changes. For example, if BI reveals a specific customer segment is underperforming, targeted marketing campaigns can be developed and their impact on sales and customer lifetime value can be meticulously tracked.

This creates a direct line of sight between BI insights and bottom-line results.

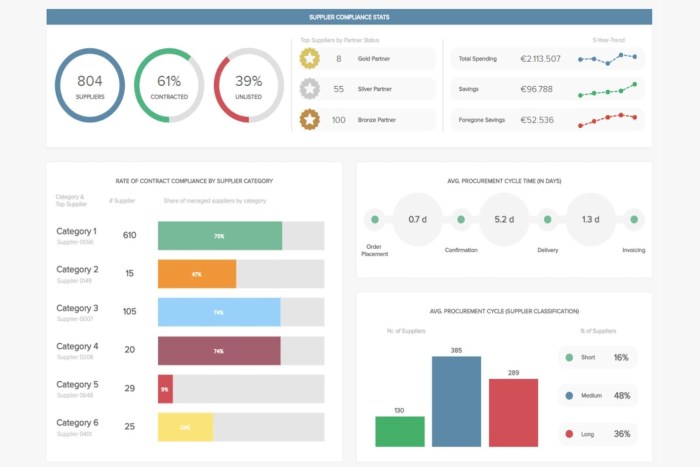

Dashboard Visualizing Key BI Success Metrics

A well-designed dashboard provides a clear, concise overview of BI performance. This allows for quick identification of successes, areas needing improvement, and overall ROI. The following table provides an example of a BI success dashboard. Note that the specific metrics and targets will vary based on individual business needs.

| Metric | Measurement Method | Target Value | Current Status |

|---|---|---|---|

| Decision-Making Speed | Time taken to make key strategic decisions (pre- and post-BI implementation) | Reduce decision time by 25% | Reduced by 20% |

| Operational Efficiency | Reduction in operational costs (e.g., inventory management, logistics) | Reduce costs by 15% | Reduced by 12% |

| Customer Satisfaction | Customer satisfaction scores (CSAT) and Net Promoter Score (NPS) | Increase CSAT by 10 points, increase NPS by 5 points | CSAT increased by 8 points, NPS increased by 3 points |

| Market Share | Market share percentage within the target segment | Increase market share by 5% | Increased by 3% |