Using Business Intelligence for Sales Forecasting and Planning isn’t just about crunching numbers; it’s about unlocking the hidden potential within your data to make smarter, data-driven decisions. This deep dive explores how leveraging BI transforms sales forecasting from a guessing game into a strategic advantage, revealing how to harness the power of data to predict future sales, optimize resource allocation, and ultimately, boost your bottom line.

We’ll uncover the secrets to building accurate forecasts, designing interactive dashboards, and implementing effective scenario planning to navigate the ever-changing market landscape.

From understanding the different data sources and integration challenges to mastering forecasting techniques and building compelling visualizations, we’ll equip you with the knowledge and tools to confidently navigate the world of sales forecasting. We’ll also delve into the crucial aspects of monitoring and evaluating your forecasts, ensuring continuous improvement and maximizing the ROI of your BI investment. Get ready to transform your sales strategy from reactive to proactive!

Introduction to Business Intelligence for Sales Forecasting: Using Business Intelligence For Sales Forecasting And Planning

In today’s hyper-competitive market, accurate sales forecasting isn’t just beneficial—it’s essential for survival. Businesses that can reliably predict future sales are better positioned to optimize inventory, allocate resources effectively, and ultimately, boost their bottom line. This is where Business Intelligence (BI) steps in, transforming the way companies approach sales forecasting and planning.Business Intelligence, in the context of sales, is the process of collecting, analyzing, and interpreting sales data to gain actionable insights.

It leverages a variety of tools and techniques to uncover patterns, trends, and anomalies within sales performance, allowing businesses to make data-driven decisions instead of relying on gut feeling or outdated methods. Think of it as a powerful magnifying glass, revealing hidden opportunities and potential risks within your sales data.

Benefits of Leveraging BI for Sales Forecasting and Planning

BI offers a significant advantage over traditional forecasting methods. By providing a holistic view of sales data, BI enables businesses to identify key performance indicators (KPIs) that directly impact sales, such as conversion rates, average order value, and customer lifetime value. This granular level of insight allows for more precise forecasting, leading to improved resource allocation, reduced inventory costs, and ultimately, increased profitability.

For instance, a company using BI might discover a seasonal surge in demand for a particular product, allowing them to proactively increase production and avoid stockouts. Conversely, they might identify a product line consistently underperforming, prompting strategic adjustments like price changes or marketing campaigns.

Key Components of a Successful BI-Driven Sales Strategy

A successful BI-driven sales strategy relies on several interconnected components. Firstly, it necessitates the implementation of a robust data collection and management system. This ensures that all relevant sales data—from CRM systems, point-of-sale (POS) systems, and marketing automation platforms—is accurately captured and stored. Secondly, the selection of appropriate BI tools and software is crucial. These tools should offer the necessary analytical capabilities to process and interpret the vast amounts of data collected.

Thirdly, a skilled team capable of analyzing the data and translating the insights into actionable strategies is essential. Finally, a culture of data-driven decision-making must be fostered within the organization, ensuring that the insights gleaned from BI are effectively integrated into the sales process.

Comparison of Traditional and BI-Driven Forecasting Methods

The following table highlights the key differences between traditional forecasting methods and those driven by Business Intelligence:

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Traditional (e.g., moving average) | Relies on historical sales data and simple mathematical calculations to predict future sales. | Simple to implement, requires minimal data analysis skills. | Limited accuracy, fails to account for external factors, susceptible to inaccuracies in historical data. |

| BI-Driven Forecasting | Utilizes advanced analytics, machine learning, and data visualization to analyze various data sources and create more accurate sales forecasts. | Higher accuracy, incorporates external factors (market trends, economic conditions), identifies patterns and anomalies. | Requires investment in technology and skilled personnel, can be complex to implement. |

Data Sources and Integration for Sales Forecasting

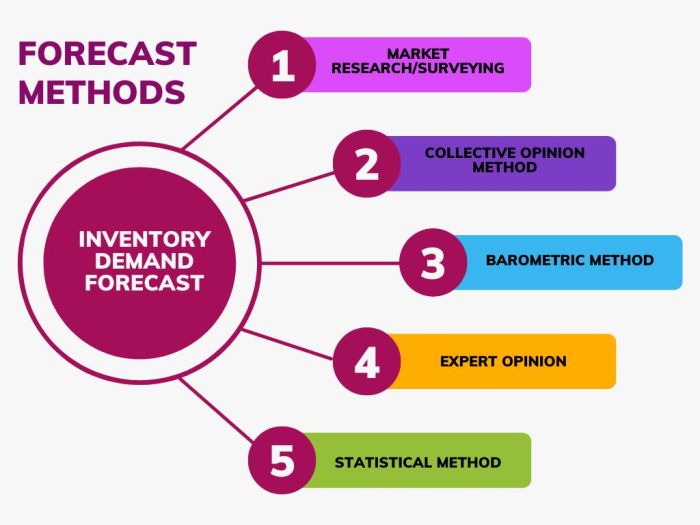

Accurate sales forecasting hinges on the quality and comprehensiveness of the data used. Leveraging a robust data integration strategy is crucial for building a reliable predictive model. This involves identifying relevant data sources, integrating them effectively, and cleaning the data to ensure accuracy.

Sales forecasting requires a holistic view of your business and market, pulling data from various internal and external sources. A successful strategy integrates these disparate data points to provide a unified and actionable picture for informed decision-making.

Internal Data Sources for Sales Forecasting

Internal data offers a deep understanding of your company’s past performance and current operations. This historical context is essential for predicting future sales trends. These sources provide valuable insights into customer behavior, sales patterns, and operational efficiency.

Examples include:

- CRM Data: Customer relationship management (CRM) systems store detailed information about customers, including purchase history, demographics, and interaction logs. This data allows for personalized forecasting and identifying high-value customers.

- Sales Transaction Data: This includes sales orders, invoices, and payment information, providing a direct measure of past sales performance. Analyzing this data reveals seasonal trends, product popularity, and regional variations.

- Inventory Data: Tracking inventory levels helps anticipate potential stockouts or overstocking, influencing sales projections. Low inventory could limit sales, while excess inventory might signal weak demand.

- Marketing Data: Information on marketing campaigns, such as ad spend, website traffic, and social media engagement, provides insights into the effectiveness of marketing efforts and their impact on sales.

- Sales Team Performance Data: Data on individual sales representative performance, including sales targets achieved, can be used to improve forecasting accuracy and identify areas for improvement.

External Data Sources for Sales Forecasting

Looking beyond internal data provides a broader context for forecasting. External data helps understand market trends, economic conditions, and competitor activities, contributing to more accurate predictions.

Examples include:

- Economic Indicators: Macroeconomic data, such as GDP growth, inflation rates, and unemployment figures, can significantly influence consumer spending and sales. For example, a recession might lead to decreased consumer spending, impacting sales forecasts.

- Market Research Data: Reports from market research firms provide insights into market size, customer preferences, and competitive landscape. This data can help refine sales projections and identify new market opportunities.

- Competitor Data: Analyzing competitor pricing, product launches, and marketing activities helps assess market share and identify potential threats or opportunities. This data is often publicly available or can be obtained through market research.

- Social Media Data: Analyzing social media sentiment towards your brand and products can reveal customer perceptions and potential issues affecting sales. For instance, negative social media buzz could indicate a decline in sales.

- Weather Data: For certain industries (e.g., agriculture, tourism), weather patterns can significantly impact sales. Unusually cold weather could reduce sales of summer clothing, for example.

Challenges of Integrating Diverse Data Sources

Integrating data from various sources presents significant challenges. Differences in data formats, structures, and quality can hinder the creation of a unified view. Data silos and lack of standardization are common obstacles.

Addressing these challenges requires careful planning and the use of appropriate data integration tools and techniques.

Data Cleaning and Preprocessing Techniques

Before using data for forecasting, thorough cleaning and preprocessing are essential. This involves handling missing values, outliers, and inconsistencies to ensure data accuracy and reliability.

Key techniques include:

- Handling Missing Values: Missing data can be imputed using various methods, such as mean imputation, median imputation, or more sophisticated techniques like K-Nearest Neighbors.

- Outlier Detection and Treatment: Outliers can skew forecasting models. Techniques like box plots and Z-score analysis can identify outliers, which can then be removed or adjusted.

- Data Transformation: Transforming data (e.g., using logarithmic transformations) can improve the performance of forecasting models by addressing skewed distributions.

- Data Standardization/Normalization: Scaling data to a common range (e.g., using Z-score normalization or min-max scaling) is crucial when using algorithms sensitive to feature scaling.

Data Integration Pipeline for Sales Forecasting, Using business intelligence for sales forecasting and planning

A well-designed data integration pipeline is critical for efficient and accurate sales forecasting. This pipeline should automate data extraction, transformation, and loading (ETL) processes.

A typical pipeline might involve:

- Data Extraction: Data is extracted from various sources using APIs, database connectors, or web scraping techniques.

- Data Transformation: Data is cleaned, preprocessed, and transformed into a consistent format suitable for analysis. This step often involves data validation, deduplication, and data type conversion.

- Data Loading: Cleaned and transformed data is loaded into a data warehouse or data lake for analysis and forecasting using BI tools.

- Data Analysis and Forecasting: BI tools are used to analyze the integrated data and build predictive models using techniques like time series analysis, regression, or machine learning algorithms.

Forecasting Techniques and Models

Predicting future sales accurately is crucial for business success. This requires a deep understanding of various forecasting techniques and the ability to select the most appropriate model for your specific data and business needs. Choosing the right model can significantly improve the accuracy of your sales forecasts, leading to better resource allocation, inventory management, and overall profitability.

Several forecasting models exist, each with its own strengths and weaknesses. The optimal choice depends heavily on the nature of your sales data, the resources available, and the level of accuracy required. Understanding these models is key to making informed decisions.

Time Series Analysis

Time series analysis utilizes historical sales data to identify patterns and trends over time. These patterns, such as seasonality, trend, and cyclical fluctuations, are then extrapolated into the future to generate a forecast. For example, a company selling ice cream might observe significantly higher sales during summer months. A time series model could capture this seasonality and project higher sales for the upcoming summer.

Simple moving averages, exponential smoothing, and ARIMA models are common techniques within time series analysis. Simple moving averages calculate an average of sales over a specified period, while exponential smoothing gives more weight to recent data. ARIMA models are more complex, accounting for autocorrelations within the data. The choice depends on data characteristics and complexity.

Regression Analysis

Regression analysis explores the relationship between sales and other influencing factors. For instance, a company might find a strong correlation between advertising expenditure and sales. Regression analysis can then be used to predict future sales based on planned advertising spending. Linear regression is a common approach, modeling a linear relationship between the dependent variable (sales) and independent variables (advertising, price, etc.).

However, more complex relationships might require non-linear regression models. For example, a company selling luxury goods might find that sales increase at a decreasing rate as price increases, requiring a non-linear model to accurately capture this relationship.

Model Selection Considerations

Choosing the right forecasting model is critical for accuracy. Several factors need consideration:

The choice of forecasting model hinges on several key factors. Ignoring these can lead to inaccurate predictions and poor decision-making. Let’s delve into the crucial aspects to consider:

- Data Characteristics: The nature of your sales data (e.g., stable, seasonal, cyclical, trended) significantly influences model selection. Seasonal data benefits from models that explicitly account for seasonality, while stable data might be best suited to simpler models.

- Data Availability: The length and quality of your historical data will constrain your options. Complex models require substantial data, while simpler models can work with limited data.

- Forecasting Horizon: The time frame of your forecast (short-term vs. long-term) also plays a role. Short-term forecasts often benefit from simpler models, while long-term forecasts may necessitate more sophisticated approaches that account for potential shifts in market conditions.

- Accuracy Requirements: The level of accuracy required will determine the complexity and sophistication of the model. Higher accuracy demands often justify more complex models, but at the cost of increased computational resources and potentially decreased interpretability.

- Computational Resources: Complex models require more computational power and expertise. Consider your available resources before selecting a model.

- Interpretability: Some models are more easily interpretable than others. If understanding the underlying drivers of your forecast is crucial, choose a model that provides clear insights into the relationships between variables.

Building Interactive Dashboards and Reports

Building interactive dashboards and reports is crucial for translating complex sales forecasting data into actionable insights. These tools allow sales teams and leadership to easily visualize trends, identify potential problems, and make data-driven decisions to optimize sales strategies. Effective dashboards and reports are tailored to the specific needs and roles of different stakeholders, ensuring that everyone has access to the information they need to succeed.

Key Metrics and Visualizations for Sales Forecasting Dashboards

A well-designed sales forecasting dashboard should prioritize key performance indicators (KPIs) that provide a clear and concise overview of sales performance against forecasts. Visualizations should be chosen to effectively communicate these metrics, making it easy to identify trends and anomalies.

- Sales Revenue: Displayed as a line graph showing actual sales versus forecasted sales over time, highlighting variances and potential areas of concern. This allows for quick identification of underperformance or overachievement.

- Sales Growth Rate: Presented as a bar chart comparing growth rates across different periods (e.g., month-over-month, year-over-year), allowing for easy comparison of performance across different timeframes.

- Conversion Rates: Shown as a funnel chart illustrating the stages of the sales process and the percentage of leads converting at each stage. This helps pinpoint bottlenecks and areas for improvement in the sales process.

- Average Deal Size: Displayed as a line graph or bar chart, tracking the average value of closed deals over time. This allows for analysis of pricing strategies and deal negotiation effectiveness.

- Sales by Product/Region/Salesperson: Presented using interactive maps or bar charts to allow users to drill down into specific regions, products, or sales representatives to pinpoint areas of strength and weakness.

Interactive Dashboards and Improved Decision-Making

Interactive dashboards empower sales teams and management to make more informed and timely decisions. The ability to drill down into data, filter information, and visualize different aspects of the forecast facilitates a deeper understanding of sales performance.For instance, an interactive dashboard allows sales managers to quickly identify underperforming sales representatives and delve into the reasons for their underperformance. They can filter data by product, region, or customer segment to pinpoint specific areas needing attention.

This enables proactive intervention and targeted coaching, ultimately leading to improved sales performance. Similarly, the ability to easily compare actual sales against forecasts enables swift adjustments to sales strategies based on real-time data.

Sample Dashboard Design

Imagine a dashboard with a large central area dominated by a line graph comparing actual and forecasted sales revenue over the past year and the next quarter. To the left, smaller charts display key metrics like sales growth rate (bar chart), conversion rates (funnel chart), and average deal size (line chart). On the right, an interactive map of sales regions displays sales performance geographically, allowing users to click on specific regions for a detailed breakdown.

At the bottom, a table provides a summary of key performance indicators for the current month and year-to-date. The entire dashboard uses a clean, consistent color scheme and clear labeling to ensure easy readability and comprehension.

Effective Report Formats for Presenting Sales Forecasts

The format of sales forecast reports should be tailored to the audience. For executive-level stakeholders, a concise summary report highlighting key trends and potential risks is sufficient. For sales teams, a more detailed report providing a product-level breakdown and regional analysis may be necessary.For example, a report for executive leadership might use a one-page executive summary with key charts showing overall revenue forecasts, growth rates, and potential risks.

In contrast, a report for sales managers could include detailed regional breakdowns, sales rep performance analysis, and potential opportunities for improvement. Reports for individual sales representatives might focus on their personal sales targets, performance against targets, and individual sales pipeline. All reports should maintain a consistent brand and style for professional presentation.

Scenario Planning and What-If Analysis

Business intelligence (BI) tools are game-changers when it comes to sales forecasting, moving beyond simple predictions to allow for proactive strategic planning. They empower businesses to explore multiple potential futures and make informed decisions based on a range of possibilities, rather than relying on a single, potentially inaccurate forecast. This involves leveraging scenario planning and what-if analysis to understand the impact of various factors on sales performance.Scenario planning, using BI, allows businesses to create multiple models representing different market conditions.

These scenarios might include optimistic, pessimistic, and most-likely outcomes, each with its own set of assumptions about economic growth, competitor actions, or changes in consumer behavior. By simulating these scenarios, businesses can identify potential risks and opportunities, and prepare contingency plans accordingly. This proactive approach helps mitigate potential negative impacts and capitalize on unexpected positive developments.

Scenario Creation and Simulation

BI tools facilitate the creation of detailed scenarios by integrating various data sources, including historical sales data, market research reports, and economic indicators. For example, a company might create three scenarios: a “high-growth” scenario assuming a strong economy and increased market share, a “moderate-growth” scenario reflecting a stable economy and moderate competition, and a “low-growth” scenario anticipating a recession and intensified competition.

Each scenario would have different inputs for key variables like market size, pricing strategies, and conversion rates. The BI tool then simulates the impact of these variables on sales figures, generating forecasts for each scenario. This allows for a comprehensive understanding of the potential range of outcomes.

What-If Analysis for Sales Strategy Evaluation

What-if analysis is a powerful technique for assessing the impact of different sales strategies. For instance, a company might use what-if analysis to determine the effect of increasing its marketing budget, launching a new product line, or expanding into a new market. The BI tool allows users to change input variables (e.g., marketing spend, pricing, discount rates) and instantly see the effect on projected sales.

This enables a data-driven approach to decision-making, helping businesses to optimize their strategies for maximum impact. For example, a company could model the impact of a 10% increase in marketing spend versus a 5% price reduction, comparing projected revenue and profitability under each scenario.

Sensitivity Analysis for Identifying Critical Factors

Sensitivity analysis helps identify the key factors that have the greatest impact on sales forecasts. This is achieved by systematically changing the input variables one at a time and observing the effect on the forecast. Variables with a significant impact on the forecast are considered critical factors, requiring close monitoring and management. For instance, a sensitivity analysis might reveal that changes in consumer confidence have a far greater impact on sales than changes in advertising spend.

This allows businesses to focus their resources on managing the most influential factors. This can be visualized using charts and graphs within the BI tool, clearly highlighting the relative importance of each factor.

Incorporating Risk Assessment into Sales Forecasting

Risk assessment is crucial for creating realistic and reliable sales forecasts. BI tools facilitate this by allowing the integration of qualitative risk factors, such as political instability or changes in regulations, alongside quantitative data. By assigning probabilities to different risks, businesses can incorporate uncertainty into their forecasts. For example, a company might assign a 20% probability to a competitor launching a similar product, and adjust its forecast accordingly.

This probabilistic approach provides a more nuanced and realistic view of the future, helping businesses to prepare for potential setbacks. Monte Carlo simulations, often integrated within BI platforms, are particularly useful for incorporating uncertainty and risk into forecasting models. These simulations run thousands of iterations, each with slightly different inputs, to generate a range of possible outcomes, giving a clearer picture of the potential variability of sales.

Further details about best business intelligence tools for small businesses is accessible to provide you additional insights.

Sales Planning and Resource Allocation

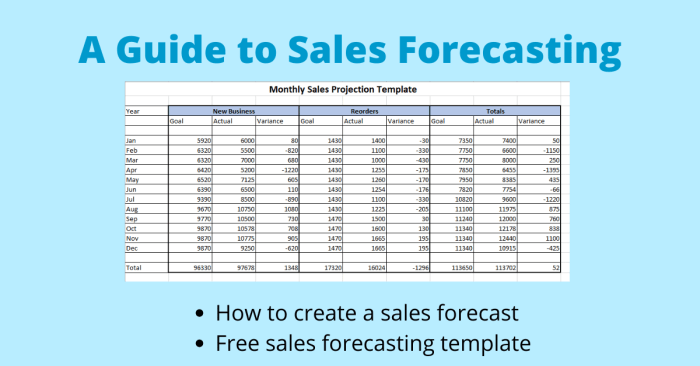

Accurate sales forecasting, powered by robust business intelligence (BI), is the cornerstone of effective sales planning and resource allocation. It allows businesses to move beyond guesswork and make data-driven decisions that optimize performance and maximize return on investment. By leveraging BI insights, companies can strategically allocate resources, ensuring they are deployed where they will yield the greatest impact.BI-driven sales forecasts directly influence resource allocation decisions across various aspects of the business.

Forecasts provide quantifiable data that justifies budget requests, informs staffing decisions, and guides inventory management. This data-driven approach minimizes risk and ensures resources are aligned with projected sales demand.

Budget Allocation

Sales forecasts are crucial for creating realistic and effective budgets. For example, a forecast predicting a 20% increase in sales of a specific product line would justify a corresponding increase in the marketing budget for that product, potentially including investments in new advertising campaigns or expanded sales team training. Conversely, a forecast indicating a decline in sales for another product might necessitate a reduction in its associated marketing spend, allowing resources to be redirected to more promising areas.

This ensures that budget allocation is directly tied to anticipated sales performance, optimizing resource utilization.

Personnel Allocation

Forecasts also play a critical role in determining staffing needs. If the sales forecast indicates a significant surge in demand, the company might need to hire additional sales representatives, train existing staff on new products, or even outsource some tasks to meet the increased workload. Conversely, a predicted downturn in sales may necessitate adjustments to the sales team structure, perhaps through attrition or reassignment of personnel to other departments.

This dynamic approach ensures the sales team is adequately sized and skilled to meet the predicted demands.

Sales Plan Development

Developing a sales plan based on BI-driven forecasts involves a structured process. It begins with analyzing the forecast data to identify key trends, opportunities, and potential challenges. This analysis informs the setting of realistic sales targets and the development of strategies to achieve them. The plan then Artikels specific actions, timelines, and key performance indicators (KPIs) to monitor progress.

Regular monitoring and adjustments are crucial to ensure the plan remains aligned with evolving market conditions and sales performance.

Integration with Other Business Functions

Effective sales planning requires seamless integration with other business functions. For example, marketing campaigns should be aligned with sales forecasts to ensure they target the right customers at the right time. Operations must also be synchronized with sales projections to ensure sufficient inventory levels and timely delivery of products. This integrated approach ensures all departments work collaboratively to achieve common sales goals.

A disconnect between sales forecasts and other business functions can lead to inefficiencies and missed opportunities.

Sample Sales Plan

The following example illustrates how sales forecasts inform key decisions within a sales plan:

- Product: New Fitness Tracker “FitPulse Pro”

- Sales Forecast (Next Quarter): 15,000 units based on BI analysis of market trends, competitor activity, and historical sales data.

- Budget Allocation: $50,000 for digital marketing (social media ads, influencer campaigns), $20,000 for print advertising in fitness magazines, $10,000 for sales team training on new features.

- Personnel Allocation: No additional hires needed; existing sales team can handle projected volume with optimized sales strategies.

- Sales Targets: Achieve 15,000 units sold; maintain a conversion rate of 5% from website visits; achieve an average order value of $120.

- Inventory Management: Order 16,000 units to account for potential variations in sales and maintain sufficient stock levels.

- Marketing Strategy: Target fitness enthusiasts aged 25-45 through digital channels; leverage influencer marketing to increase brand awareness.

- Sales Strategy: Implement a targeted email campaign to existing customers; offer early bird discounts and bundles to incentivize purchases.

Monitoring and Evaluation of Sales Forecasts

Accurate sales forecasting isn’t just about predicting the future; it’s about continuously refining your predictions to better align with reality. Monitoring and evaluating your forecasts allows you to identify weaknesses, adjust strategies, and ultimately, improve the accuracy of your sales planning. This process is crucial for optimizing resource allocation and maximizing revenue.

Regularly assessing the performance of your sales forecasts is essential for maintaining their relevance and value. By tracking key metrics and implementing adjustments based on real-time data, businesses can significantly enhance their forecasting capabilities and reduce the risk of inaccurate predictions. This proactive approach ensures that sales strategies remain aligned with market dynamics and evolving customer behavior.

Key Performance Indicators (KPIs) for Forecast Accuracy

Several key performance indicators (KPIs) provide insights into the accuracy of your sales forecasts. Monitoring these metrics allows for a comprehensive understanding of forecast performance and identifies areas requiring attention. The choice of KPIs will depend on the specific business and its forecasting goals, but some common and effective ones are detailed below.

- Mean Absolute Deviation (MAD): This metric calculates the average absolute difference between forecasted and actual sales. A lower MAD indicates higher accuracy.

- Mean Absolute Percentage Error (MAPE): MAPE expresses the average absolute percentage difference between forecasted and actual sales. It provides a relative measure of forecast accuracy, making it easier to compare forecasts across different periods or product lines. For example, a MAPE of 5% indicates that, on average, the forecast was off by 5%.

- Root Mean Squared Error (RMSE): RMSE is a more sensitive measure than MAD, penalizing larger errors more heavily. This is useful when large forecast errors are particularly costly.

- Forecast Bias: This indicates whether the forecast consistently overestimates or underestimates sales. A positive bias suggests overestimation, while a negative bias indicates underestimation.

Tracking Forecast Accuracy and Identifying Areas for Improvement

Tracking forecast accuracy involves a systematic process of comparing forecasted sales figures with actual sales data. This comparison should be done regularly, ideally at least monthly, to identify trends and patterns in forecast errors. This allows for prompt adjustments to forecasting methodologies and strategies.

For example, a company might discover that its forecasts for a particular product consistently underestimate sales during the holiday season. This insight would prompt an investigation into the forecasting model used for that product during this period, potentially leading to adjustments in the model’s parameters or the incorporation of additional relevant data points, such as historical holiday sales data or promotional campaign effectiveness.

Adjusting Sales Forecasts Based on Real-Time Data and Market Changes

Sales forecasts are not static; they need to be dynamic and adaptable. Real-time data, such as daily sales figures, website traffic, and social media sentiment, provide valuable insights that can inform forecast adjustments. Similarly, significant market changes, such as economic downturns or the emergence of a new competitor, require immediate reassessment of forecasts.

Imagine a company experiencing unexpectedly high demand for a product due to positive social media buzz. By monitoring this real-time data, the company can immediately adjust its sales forecast upwards, ensuring it has sufficient inventory and resources to meet the increased demand. Conversely, a sudden economic downturn might necessitate a downward adjustment to account for decreased consumer spending.

Best Practices for Continuous Improvement in Sales Forecasting Processes

Continuous improvement is key to achieving accurate and reliable sales forecasts. Regularly reviewing forecasting methods, incorporating feedback from sales teams, and leveraging advanced analytics are crucial aspects of this process.

- Regularly review and update forecasting models: Models should be refined based on past performance and changing market conditions.

- Incorporate qualitative data: Sales team insights, market research, and expert opinions should be integrated with quantitative data for a more holistic forecast.

- Utilize advanced analytics techniques: Machine learning algorithms can improve forecast accuracy by identifying complex patterns and relationships in data.

- Establish a feedback loop: Regularly compare forecasts to actual results and use this information to improve future forecasts.

- Document and share best practices: Create a repository of successful forecasting techniques and share knowledge across the organization.